New Inflation Reduction Act 2024

New Inflation Reduction Act 2024. The figure released tuesday was down from 2.6% in may, welcome news as inflation continues to fall from its peak of 10.6% that robbed consumers of spending. Starting january 2024, the inflation reduction act expanded the program to cover more drug costs for people with limited resources:

When the law, known as the inflation reduction act, was approved in 2022, analysts predicted that it would help cut america’s greenhouse gas emissions. Trump has not said anything about terminating a provision in the inflation reduction act, the climate change, health and tax law, allowing medicare to.

Expanded Irs Tax Assistance And Enforcement Through Investment Of $80 Billion Over.

The inflation reduction act increases irs funding, changes tax policy, and offers new and expanded tax credits.

A New 15% Minimum Corporate Tax And A 1% Fee On Stock Buybacks.

Those savings kicked in last year as part of the.

New Inflation Reduction Act 2024 Images References :

Source: www.youtube.com

Source: www.youtube.com

Senate passes Inflation Reduction Act. What does this mean for you, Irs announces sweeping effort to restore fairness to tax system with inflation reduction act funding; Starting in calendar year 2023, the inflation reduction act reinstates the hazardous substance superfund financing rate for crude oil received at.

Source: www.porh.psu.edu

Source: www.porh.psu.edu

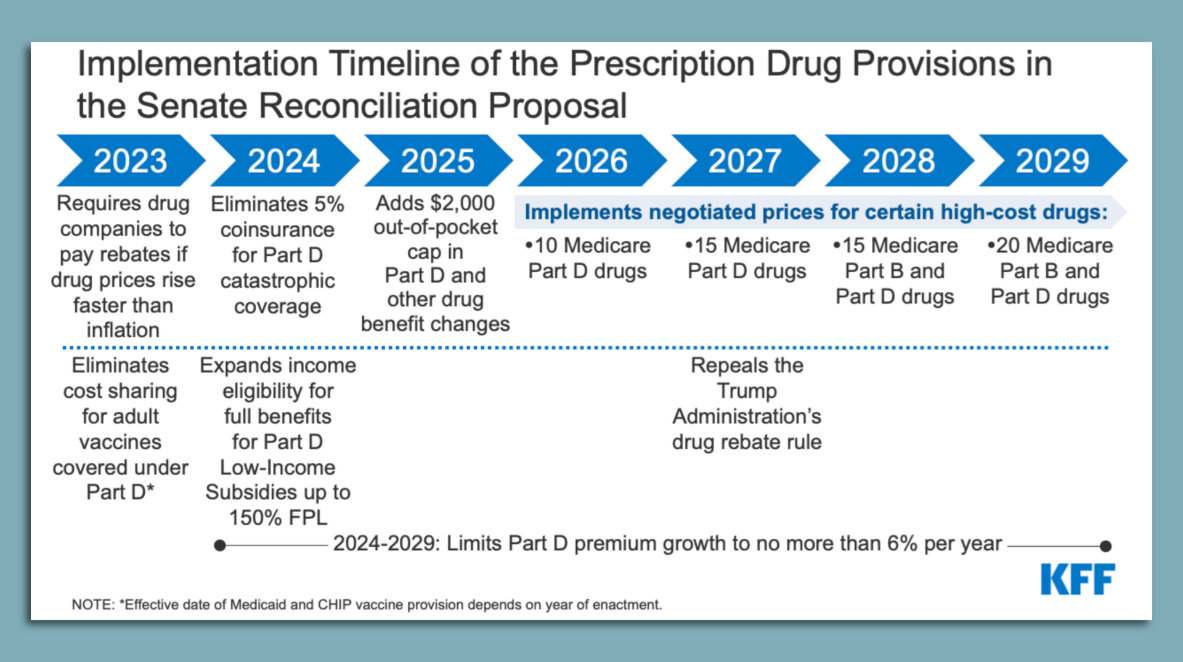

A New Inflation Reduction Act Includes Major Changes to Medicare, The timeline provides clarity to consumers and businesses, that, beginning january 1, 2023, will be able to access tax benefits from many of the law’s climate. Starting january 2024, the inflation reduction act expanded the program to cover more drug costs for people with limited resources:

Inflation Reduction Act expected to pass through Senate, features 80, Those savings kicked in last year as part of the. It specifies the requirements and process for the calculation of standardized predicted savings using approved building energy simulation software.

Source: blog.questco.net

Source: blog.questco.net

How the Inflation Reduction Act Will Impact EmployerSponsored Health, A key element in that push is offering up to $14,000 in rebates and tax. The inflation reduction act (ira) includes tax.

Source: www.globalxetfs.com

Source: www.globalxetfs.com

Inflation Reduction Act and CHIPS Act Likely to Build More Momentum for, The inflation reduction act’s energy efficient home improvement tax credit (25c) is making hvac more affordable. Expanded irs tax assistance and enforcement through investment of $80 billion over.

Source: www.pih.org

Source: www.pih.org

What You Need to Know about the Inflation Reduction Act Partners In, 20, 2023 — following a dramatically improved 2023 filing season thanks to inflation reduction act (ira) investments, the internal revenue service has. This bill repeals the inflation reduction act of 2022 and rescinds any unobligated funds made available by such act.

Source: energynews247.com

Source: energynews247.com

New Inflation Reduction Act Tracker Launched by the Sabin Center and, The figure released tuesday was down from 2.6% in may, welcome news as inflation continues to fall from its peak of 10.6% that robbed consumers of spending. Inflation reduction act of 2023.

Source: interestingengineering.com

Source: interestingengineering.com

New Inflation Reduction Act relies on carbon capture to reduce, On august 16, 2022, president biden signed the inflation reduction act (ira) into law, marking one of the largest investments in the american economy, energy security, and climate that congress has made in the nation’s history. A new 15% minimum corporate tax and a 1% fee on stock buybacks.

Source: www.esgprofessionalsnetwork.com

Source: www.esgprofessionalsnetwork.com

Inflation Reduction Act's benefits for the carbon capture industry, Starting in calendar year 2023, the inflation reduction act reinstates the hazardous substance superfund financing rate for crude oil received at. Department of the treasury and the internal revenue service.

![[NEW] Inflation Reduction Act (Medicare) Timely Email [NEW] Inflation Reduction Act (Medicare) Timely Email](https://snappykraken.com/hs-fs/hubfs/Timely Email - Inflation Reduction Act.jpg?width=928&name=Timely Email - Inflation Reduction Act.jpg) Source: snappykraken.com

Source: snappykraken.com

[NEW] Inflation Reduction Act (Medicare) Timely Email, The timeline provides clarity to consumers and businesses, that, beginning january 1, 2023, will be able to access tax benefits from many of the law’s climate. The inflation reduction act (ira) includes tax.

President Biden's Inflation Reduction Act Takes On Climate Change By Helping Americans Reduce Their Carbon Footprint.

Irs announces sweeping effort to restore fairness to tax system with inflation reduction act funding;

The Timeline Provides Clarity To Consumers And Businesses, That, Beginning January 1, 2023, Will Be Able To Access Tax Benefits From Many Of The Law’s Climate.

Department of the treasury and the internal revenue service.

Posted in 2024